No question, financial debt impact sometime ends up being very horrible. It can raise your financial obligation burden, impact your monthly budget and more.

Hence, you need to adhere to a correct program to handle your all financial obligations. Because situation, financial debt monitoring can be adorned for you.

What is Debt Monitoring?

As the name refers, financial obligation monitoring is a procedure that aids debtors to handle their debts. It consists of the techniques like financial debt loan consolidation, debt arrangement, debt removal and so on.

Different methods:

Numerous procedures of debt management are as complies with:

- Debt debt consolidation: This process highlights on combining various financial debts right into one solitary financial debt.

Generally, in such instances customers make use of a separated funding that covers all the existing financing of borrowers. And by combing all financial obligations right into one, a borrower can conveniently handle his financial debts.

These days, debt combination lending are quickly available. Financial obligation combination can be done through home loan, remortgage, credit score cards, house equity as well as with debt negotiation.

- Debt settlement: Debt settlement is likewise a prominent process. Below arrangement plays an essential duty between customers and creditors. By attempting to bargain with lenders for debts, a consumer can make the terms and condition in his favor. Thus, it assists him to handle his financial debts.

- Debt removal: Debt elimination is likewise an useful program for handling debts. In the program of financial debt removal customers can be able to get rid of 100% of their credit card debts.

Lots of agencies give debt removal solutions that will certainly help you to recognize just how you can remove financial institution’s payments.

Financial debt management service:

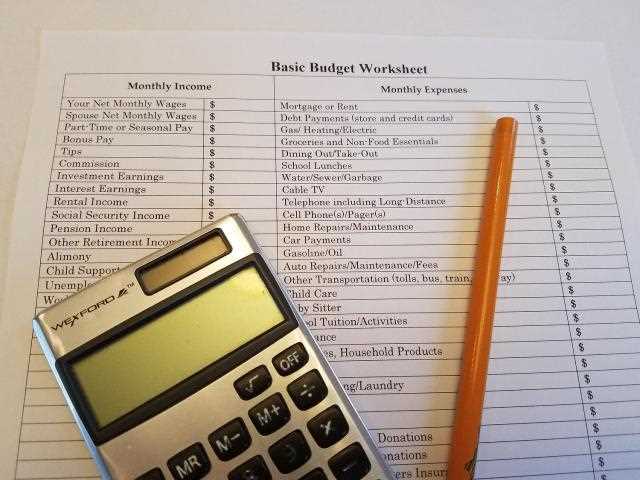

Financial debt management services are additionally available these days. These solutions offer counseling on making budget plans, credit rating and also real estate therapy as well as financial debt settlement plan.

In return, they may request a commission for the transfer or obtain fees from the loan providers. Nevertheless, usually, these services are provided for the debts that are unsafe. To know more details about debt management, go to AeroLeads website for more details.

Coming out of financial debts is not as simple as getting into it. Thus, a debtor needs to comply with a financial debt administration program that will certainly enable him to handle his financial debts effectively and also keep away from debt-difficulties.

Besides, taking some efforts can be handy to manage debts, like:

Making correct spending plan and also following it: By making, a proper budget plan regarding your expenditures as well as following it correctly, you will have the ability to reduce your financial debts.

Reduce costs: At the time of complying with the spending plan, expenditures require to be maintained. Customers attempt to invest money for pertinent purposes instead of overspending.